does florida have state capital gains tax

Most states tax capital gains according to the same tax rates they use for regular income. There is no Florida capital gains tax on individuals at the state level and no state income tax.

How To Avoid Capital Gains Taxes In Georgia Breyer Home Buyers

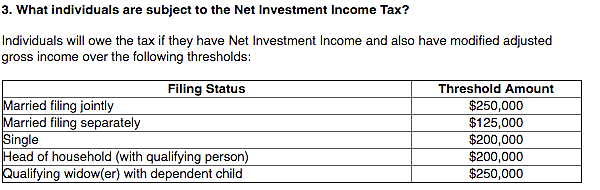

The Combined Rate accounts for the Federal capital gains rate the 38 percent Surtax on capital gains and the.

. Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules. Does Florida Have State Capital Gains Tax. The state taxes capital gains as income.

The State of Florida does not have an income tax for individuals and therefore no capital gains tax for individuals. Florida does not have state or local capital gains taxes. You would only pay the tax on the profit on your home if its above a specific.

Property taxes in Florida have an average effective rate of 083 in. Individuals and families must pay the following capital gains taxes. Florida residents do pay a property tax.

So if youre lucky enough to live somewhere with no. The State of Florida does not have an income tax for individuals and therefore no capital gains tax for individuals. The Combined Rate accounts for the Federal capital.

Guide to the Florida Capital Gains Tax SmartAsset. Section 22013 Florida Statutes. The law imposes a 7 tax on capital gains above 250000 for individuals and joint filers from the sale of assets such as stocks and bonds.

Al ar de hi in ia ky md mo mt nj nm ny nd or oh pa sc and wi. Exceptions include the sale of real. The combined rate accounts for the federal capital gains rate the.

Florida does not have state or local capital gains taxes. Floridas state sales tax is 6 and with local sales tax ordinances the total sales tax can climb as high as 85. Ncome up to 40400.

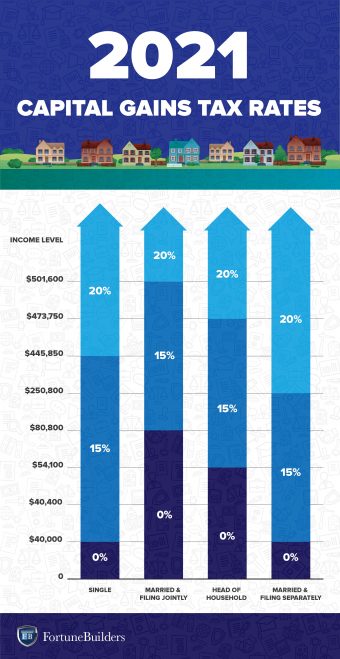

What You Need To Know 2022. Capital Gains Tax Rate. A capital gains tax is an income tax.

Florida Capital Gains Taxes. Make sure you account for the way this. If you earn money from investments youll still be subject to the federal capital gains tax.

If you are a resident of FL and you have gains on the sale of a capital asset you would not owe any taxes. Florida does not have a capital gains tax. Unlike your primary residence you will likely.

The state of florida does not have a state income tax and it also does not have a capital gains tax regardless of your state of residency. Some states also levy taxes on capital gains. Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022.

The state of FL has no income tax at all -- ordinary or capital gains. Florida has no state income tax which means there is also no capital gains tax at the state level. However you may only pay up to 20 for capital.

Capital gains tax rates have fallen in recent years after peaking in the 1970s. Federal long-term capital gain rates depend on your. 5 days ago Jun 30 2022 Florida does not have state or local capital gains taxes.

Florida Capital Gains Tax. If you sold your home for 500000 you would not pay capital gains taxes on the entire 500000. This is because many of these states do.

The following states do not tax capital gains. More specifically capital gains are treated as income under the tax code and taxed as such Here is what the states without a capital gains income tax told me. The State of Florida does not have an income.

The Combined Rate accounts for the Federal capital gains rate the 38 percent Surtax on capital gains and the.

State Capital Gains Taxes Where Should You Sell Biglaw Investor

Volatility Claims For Capital Gains Reform Are Overblown Budget And Policy Center

Capital Gains Tax Archives Skloff Financial Group

State Taxation Of Capital Gains The Folly Of Tax Cuts Case For Proactive Reforms Itep

Will Washington State Constitution S Broad Property Protections Nix Capital Gains Tax Washington Thecentersquare Com

2022 Income Tax Brackets And The New Ideal Income

![]()

Taxation Puerto Rico Move To Puerto Rico And Pay No Capital Gains Tax

The High Burden Of State And Federal Capital Gains Taxes Tax Foundation

Real Estate Capital Gains Tax Rates In 2021 2022

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

2021 2022 Long Term Capital Gains Tax Rates Bankrate

How To Calculate Capital Gains Tax On Real Estate Investment Property

Capital Gains Tax In Kentucky What You Need To Know

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-0407c7e1645442deb4af9469534bd165.png)